The Importance of Year-End Tax Planning for Individuals and Businesses

Year-end tax planning is a cornerstone of financial success for individuals and businesses. By addressing your tax situation proactively, you can reduce liabilities, improve cash flow, and prepare confidently for the new year. Consult with your accountant today to take full advantage of time-sensitive opportunities and navigate the complexities of the tax code.

The 2024 POTUS Election Won't Impact Your Taxes Much, but the Expiring Tax Cuts and Jobs Act Will

As the 2024 presidential election ramps up, it’s natural to wonder what changes a new administration could bring to our tax system. While elections can certainly influence future tax policies, it's important to understand that the next administration—regardless of who wins—won't immediately or directly impact your taxes. On the other hand, the looming expiration of the Tax Cuts and Jobs Act (TCJA) at the end of 2025 has significant and direct implications for personal taxes.

Qualified Joint Venture: A Tax-Saving Strategy for Married Couples

Yes, a married couple can be treated as a qualified joint venture (QJV) for tax purposes, but certain conditions must be met. This designation allows the couple to avoid having to file a partnership tax return (Form 1065). Instead, each spouse reports their share of income and expenses on their individual Schedule C (for sole proprietors) as part of their joint or separate individual tax returns. Let’s review what other considerations should be considered in today’s blog.

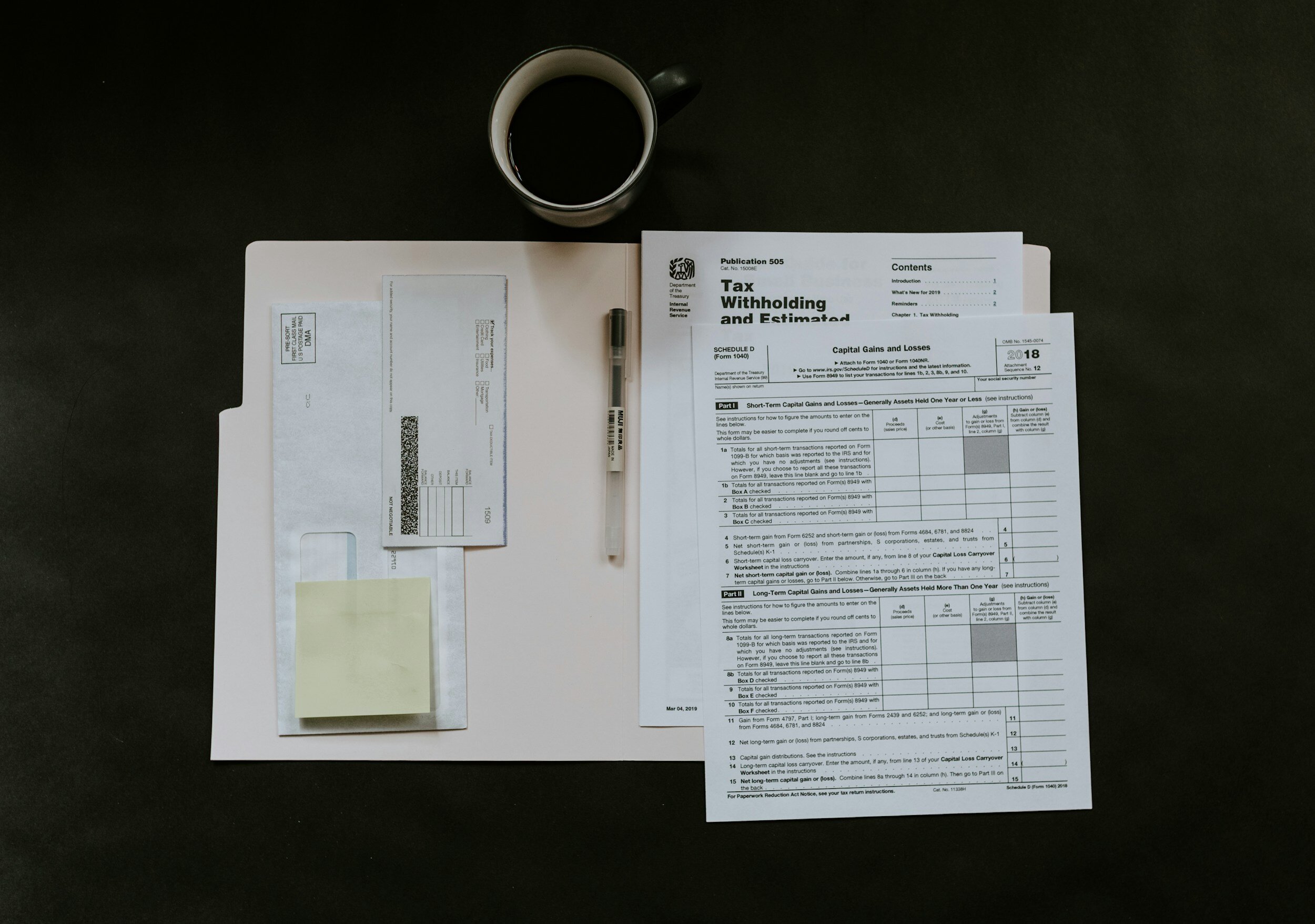

Tax Planning For Small Businesses

Tax planning for small business clients involves a strategic analysis of a business's financial situation to minimize tax liabilities and maximize tax benefits. It is an ongoing process that helps businesses make informed financial decisions.

Why Hiring a Fractional CFO/Controller Could Be The Best Business Decision You Ever Make

For small to medium-sized businesses (SMBs), financial management is a critical factor in success. However, many SMBs struggle to justify the cost of hiring a full-time Chief Financial Officer (CFO) or Controller. The solution? A fractional CFO or Controller—a cost-effective, high-impact option that provides the expertise you need without the hefty price tag.

Unlocking Business Potential: The Advantages of Forming a Single Member LLC

For entrepreneurs and small business owners, choosing the right legal structure is crucial. While operating as a sole proprietorship may seem straightforward, there are significant benefits to be gained by forming a Single Member Limited Liability Company (LLC). In this blog, we'll explore why creating a Single Member LLC can be a strategic move for your business.

The Troublesome Tale of Turbotax: Unveiling the Inaccuracies of Tax Software

In the digital age, many individuals turn to tax software for convenience and efficiency when filing their taxes. Among the most popular options is TurboTax, a widely-used software known for its user-friendly interface and promise of maximizing refunds. However, behind its glossy exterior lies a troubling truth: Turbotax can be shockingly inaccurate, potentially leading taxpayers down a perilous path of financial missteps and legal troubles.

EZ Tax Services: The Crucial Role of Bookkeepers in Empowering Small Businesses

Small businesses are the backbone of any thriving economy, contributing significantly to job creation, innovation, and overall economic growth. However, amidst the challenges and responsibilities that come with running a small business, many entrepreneurs find themselves stretched thin, trying to balance multiple roles. One crucial aspect that often takes a backseat is the meticulous management of finances. Recognizing the importance of maintaining accurate financial records, an increasing number of small businesses are turning to professional bookkeepers to handle accounting, audit, and financial tasks. In this article, we explore the pivotal role that bookkeepers play in empowering small businesses and enabling business owners to focus on what they do best – growing their businesses.

EZ Tax Services: A Local Gem Serving East Tennessee and Beyond

In the heart of Loudon, Tennessee, nestled within the vibrant community of Loudon County, is a local business that has become a beacon of financial support and expertise for individuals and businesses alike. EZ Tax Services stands out not only for its commitment to the local community but also for its widespread reach, providing invaluable services to clients not only in East Tennessee but extending its expertise across state borders.

Navigating Changes: Understanding Potential Factors Leading to Lower Tax Refunds in 2023 Compared to 2022

As taxpayers anticipate the filing of their returns in 2023, there is a growing awareness of potential changes that might result in lower tax refunds compared to the previous year. Several factors, including expiring credits and the conclusion of government programs, are contributing to this shift. In this article, we will explore these changes and their impact on the tax landscape.

Seamless Tax Solutions The Advantage of Local Year-Round Tax Firms Over Seasonal National Franchises

In the realm of tax preparation, individuals and businesses are often faced with the decision of choosing between a local tax firm that operates year-round and a nationally franchised office that is open only seasonally. This choice can significantly impact the quality of service, accessibility, and overall experience for taxpayers. In this essay, we will explore the benefits of opting for a local tax firm that operates throughout the year compared to a franchise with a seasonal presence.

EZ Tax Services Partners with Local Employers to Offer Exclusive Discounts for Employees

EZ Tax Services has formed strategic partnerships with industry leaders in the Loudon area, including Apex Canvas Company, Fort Defiance Industries, LB Foster, Malibu Boats, Monterey Mushrooms, Primient, Priority Ambulance of East Tennessee, Protomet, and Viskase. This collaboration marks a significant initiative to support the financial well-being of the local workforce.

Breaking News: EZ Tax Services Demonstrates Appreciation for Local Heroes with Exclusive Tax Preparation Discounts

EZ Tax Services of Loudon, Tennessee is now offering exclusive discounts for employees of Loudon County and City law enforcement, faire, and government employee community for high quality, professional tax preparation services.

EZ Tax Services Launches Exclusive Tax Prep Discounts for Employees of Loudon County's Largest Employers

EZ Tax Services of Loudon, Tennessee is now offering exclusive discounts for employees of the largest local area employers for high quality, professional tax preparation services.

The IRS's Stricter Stance on Unreported Cryptocurrency Capital Gains: Navigating the Tax Landscape

Just because Bitcoin and other cryptocurrencies seem anonymous the IRS is cracking down on those who don’t pay their fair share of capital gains taxes.

The Top 10 Taxes You Can Expect in Tennessee Despite No State Income Tax

Just because Tennessee has no state income tax that does not mean you will pay no tax in TN.

Bridging the Gap: The Crucial Role of Native Spanish Speakers in Bilingual Tax Preparation

Being a native Spanish speaker instead of simply bilingual is crucial to proper and professional tax return preparation.

Seamless Tax Solutions Nationwide: How Our Tennessee-Based Tax Preparation Firm Serves Clients in All 50 States

A local business with a national mindset.

Getting every deduction and credit is important.

Finding every deduction and credit available really adds up!

Tennessee: No state income tax does not mean no tax.

Just because Tennessee has no state income tax that does not mean you will pay no tax in TN.